Resources

Latest Posts

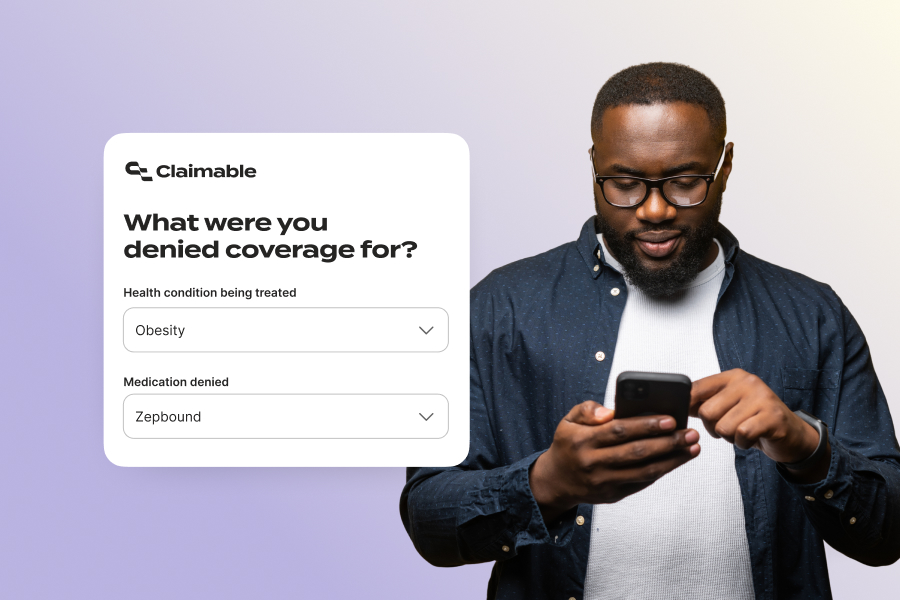

We're in the middle of a major shift in how we treat obesity, diabetes, and metabolic disease. GLP-1s have changed the game. But as usual, the people who need these medications most are being blocked—not by science, but by insurance red tape.

Coverage decisions vary wildly—and they're changing fast. What your plan covers today might change next quarter. What was approved for a friend may be completely denied for you. Some plans require extreme BMI thresholds. Others won't count progress if you paid out-of-pocket. And many still exclude GLP-1s entirely for weight loss, regardless of your health risks or clinical need.

Over the past several months, we've dug deep into this rapidly developing landscape—reviewing hundreds of real-world denials, studying shifting coverage criteria, and collaborating with patients, providers, and advocates to understand what actually works when it comes to securing insurance coverage for GLP-1s. We've built an appeals system that not only reflects the reality of this fight—but helps people win it.

No paperwork. No hold music. No fax machines. Just a simple, powerful way to get your appeal in motion—with the right evidence, the right strategy, and into the right hands. So you can get back to focusing on what matters: Your health.

Read on for the most common challenges with GLP-1 coverage, and what you can do if you get denied. And if you haven't already, you can read more about why this medication matters in this letter from our CEO.

Common GLP-1 Coverage Questions (And How We Help)

- How do I qualify for a GLP-1 prescription?

- Why did my insurance stop covering my GLP-1 after it was working?

- Can I switch from a compounded GLP-1 to a brand-name one?

- What can I do if my insurer forces me to switch medications?

- My plan says GLP-1s aren't covered - can I still appeal?

Getting Coverage for a New GLP-1 Prescription

The challenge: Insurers often require you to meet extreme and unreasonable criteria, which can feel like an impossible bar to clear.

Whether you're starting Wegovy, Zepbound, or Mounjaro, getting your first prescription covered can feel like hitting a moving target. That's because more than half of all plans with GLP-1 coverage apply criteria that are more restrictive than FDA guidelines— and criteria are changing every few months.

Some plans require BMIs as high as 40 (when the FDA standard for eligibility is 30) or multiple co-morbidities like cardiovascular disease, hypertension and obstructive sleep apnea. Others demand months of participation in a costly weight management program before considering medications. Many limit approval to just a few months, with no guarantee of continuation. And some plans require you to fail on ineffective treatments before they'll cover what actually works—which could put your health at risk.

How we fight it:

A clear, evidence-backed appeal, personalized to your unique health story and insurance policy, is key to getting coverage. When you appeal through Claimable, we show:

- How you meet the standard criteria: BMI, A1c, co-morbidities, lifestyle changes.

- Why restrictive requirements—like excessive documentation or arbitrary program rules—don't reflect medical necessity, clinical standards or applicable laws.

- Why step therapy or "preferred" drugs aren't safer or better for you.

A denial doesn't mean you don't qualify. It means the insurer wants you to give up. With the right appeal, we're here to make sure you don't.

Continuing Coverage When You're Making Progress

The challenge: Once you see success on a GLP-1, insurers can use it as justification to stop covering you.

When a GLP-1 is working, you know it: weight is coming down, blood sugar is steady, and related conditions—like high blood pressure or sleep apnea—are improving. But instead of that progress ensuring continued access, insurers often use it as a reason to demand new paperwork—or worse, to cut you off.

FDA guidance allows up to a year to demonstrate a 5% weight loss. But some plans push for three times that weight loss in one-third the time—setting unrealistic, and potentially unsafe, targets that deny care despite clear clinical benefit. Insurers claim your progress means you no longer need treatment. And if your GLP-1 journey hasn't been a straight line, your coverage could disappear altogether.

That's where we come in.

How we fight it:

We're here to make sure your progress counts—and keeps counting. Claimable's continuation appeals includes four key arguments to keep you on track.

- Highlight your progress—weight loss, A1C improvement, better sleep, lower blood pressure, and other real clinical gains.

- Clarify gaps and changes—like switching from compounded meds, adjusting your dose, or managing prior authorization delays.

- Hold insurers accountable—to medical guidelines, continuity of care protections, and coverage terms that support ongoing treatment.

- Ensure your plan follows fair, consistent policies—challenging short approval windows, moving goalposts, and arbitrary rules that ignore your rights.

If your medication is working, you shouldn't have to fight harder just to keep going.

Switching from Compounded To Brand-Name

The challenge: As of May 22, 2025, compounded copycat GLP-1s are off the market. Getting covered for the branded version of your exact same meds? Not so easy.

While branded GLP-1s were in shortage, many compounding pharmacies offered lower-cost alternatives that proved to be very popular, with an estimated 2-4 million Americans prescribed a compounded GLP-1. Now that the FDA-declared shortage has ended, those pharmacies are no longer permitted to produce copies of brand-name drugs like Wegovy or Zepbound.

Compounding pharmacies can still prescribe and produce custom formulations when medically necessary, but these medications come with risks. They don't go through the same rigorous safety and efficacy testing as FDA-approved drugs, which means they could increase health risks or be less effective.

Now, many patients are being told they don't qualify for coverage of a branded GLP-1 — even if they would have qualified initially and the compounded version was working well.

Common barriers include:

- You've already lost weight and no longer meet the starting BMI requirement.

- Your insurer won't count your cash-pay or compounded treatment history.

- You're using a GLP-1 to manage conditions like sleep apnea or cardiovascular disease — and insurers are ignoring the full picture.

How we fight it:

We build personalized appeals to make your case — showing medical necessity, continuity of care, and the real-world value of staying on treatment. Your right to access a compounded medication during the shortage was protected. Your full medication history should count now, too.

You shouldn't have to start over — or pay $400 to $700 out of pocket — just because the rules changed.

Fighting Forced Switches

The challenge: You know what works. Your insurer wants to change it.

More and more patients are being forced to switch GLP-1 medications—not because of medical need, but because insurers want to cut costs or capture rebates. These non-medical or formulary switches happen when a payer—not your provider—chooses your medication based on their bottom line.

For example: CVS Caremark recently dropped Zepbound from its formulary, pushing millions of patients to switch to Wegovy starting July 1.

These switches often have nothing to do with your health, and sometimes they don't even lower your costs. Instead, they can disrupt care, increase side effects, and lead to worse outcomes.

GLP-1 medications in particular are sensitive to disruption. Patients and providers often spend months carefully titrating to the right dose. Restarting with a new medication can trigger setbacks, new side effects, and reduced effectiveness. And medications like Zepbound and Wegovy aren't interchangeable—they have different mechanisms of action, indications, and side effect profiles.

If your current GLP-1 is working and well-tolerated, there may be no clinical reason to change. That decision should stay between you and your provider—not your insurer.

How we fight it:

Claimable helps you push back with a personalized appeal—built to preserve the treatment that's working for you (and your wallet). Our forced-switch appeals:

- Make a continuation of care case, showing how switching could harm your progress,especially with medications that require careful titration.

- Highlight clinical differences between your current and proposed medication to demonstrate they aren't interchangeable.

- Surface real-world evidence of your stability, symptom improvements, and the risks of disruption.

- Challenge the lack of medical justification for switching patients who are stable and responding well.

- Frame fiduciary risks under ERISA for the majority of employer-based plans that are self-funded.

- Flag legal and ethical concerns, particularly in states with protections against non-medical switching.

How to Appeal Plan Exclusions or "Not Covered"

The challenge: More and more plans are excluding GLP-1s from coverage.

If your denial says weight loss medications are "not a covered benefit," you're likely dealing with a plan exclusion—one of the hardest types of denials to fight. These exclusions are written directly into your insurance contract, often banning coverage for weight loss medications across the board—or blocking specific drugs like Zepbound or Wegovy—regardless of medical need.

The tough truth? About half of all health plans exclude GLP-1s for weight loss.

The silver lining? Most people with obesity also have another condition that GLP-1s are approved to treat—like type 2 diabetes, cardiovascular disease, or sleep apnea. And new FDA indications are being added all the time.

How we fight it:

Even if your plan excludes weight loss treatment, there are still ways to push back:

- Resubmit with a different diagnosis, if one applies.

- Request a formulary exception, especially if no equivalent alternative exists.

- Ask for a continuation of care exception, especially if you were previously covered—many states require it.

- Ask your employer to change or override the policy if you're on a self-funded plan.

Tip: Most large employers self-fund their plans, which means leadership—not the insurer—has the final say and a fiduciary duty to act. - File a complaint or consult a lawyer if your plan was misleading during enrollment.

Tip: Misrepresentation, breach of contract, or unfair practices may violate consumer protection laws

These appeals are harder to win—but not impossible. And the policy landscape is shifting fast. Lawsuits, new guidance, and growing public pressure are forcing insurers to reconsider blanket exclusions.

The Bottom Line

GLP-1 medications are transforming lives—but too often, access depends on your paperwork, not your progress or potential.

Insurers are hoping the red tape wears you down. That you won't appeal. That you'll switch, stop, or give up.

At Claimable, we're here to make sure you don't.

Whether you've been denied, dropped, or told you're not covered, we'll help you fight back—with expert strategies, AI-powered tools, and appeals tailored to your unique medical story and your plan's real rules.

Because you deserve access to the treatment that's working.

Because your health shouldn't hinge on fine print.

Because one denial shouldn't be the end of your story.

We get asked all the time for tips on how to write an effective Letter of Medical Necessity (LOMN). It’s one of the most critical tools in challenging an insurance denial, yet many providers aren’t sure what makes a letter truly persuasive.

After reviewing hundreds—some that succeeded, others that failed—we started to see clear patterns in what works and what doesn’t. A well-crafted LOMN isn’t just about paperwork; it’s a powerful tool to make insurers recognize what providers already know: the treatments you prescribe aren’t optional, they’re necessary.

That’s why we put together this guide: to help providers make that case clearly, confidently, and successfully.

What is a Letter of Medical Necessity?

A LOMN is a formal document from the treating provider explaining why a treatment, medication, or service is medically necessary. It can serve as a provider appeal on its own or support a prior authorization request or patient appeal.

Why the Letter of Medical Necessity Matters

A LOMN can be the deciding factor in whether a patient gets the care they need.

When making coverage decisions, insurers often rely on reviewers with limited or no expertise in the condition, a history of concerning decisions, and no insight into the patient’s history—yet they make life-changing decisions in minutes. Investigations have shown that providers and patients who appeal more frequently face fewer denials over time. By challenging every unjust denial, you fight for your patient’s care today and help prevent future denials.

An effective LOMN establishes your authority as the treating provider, documents the patient’s relevant medical history, and presents clear clinical justification for why the treatment is essential—dramatically improving the chances of approval.

Let’s break down exactly what makes a LOMN effective—and how to write one that insurers can’t ignore.

How to Write a LOMN That Gets Results

When a prior authorization or appeal is needed, act quickly. A clear, structured LOMN can make all the difference. Here’s how to do it:

- Review the Criteria: Examine the insurer’s coverage criteria or the specific denial reasons to identify what must be addressed in the letter.

- Initiate the Process: Inform your patient that a LOMN will be part of the appeal and discuss any additional details that could strengthen or expedite the case.

- Gather Key Information: Gather medical records, clinical studies, and relevant guidelines to build a strong, evidence-backed argument.

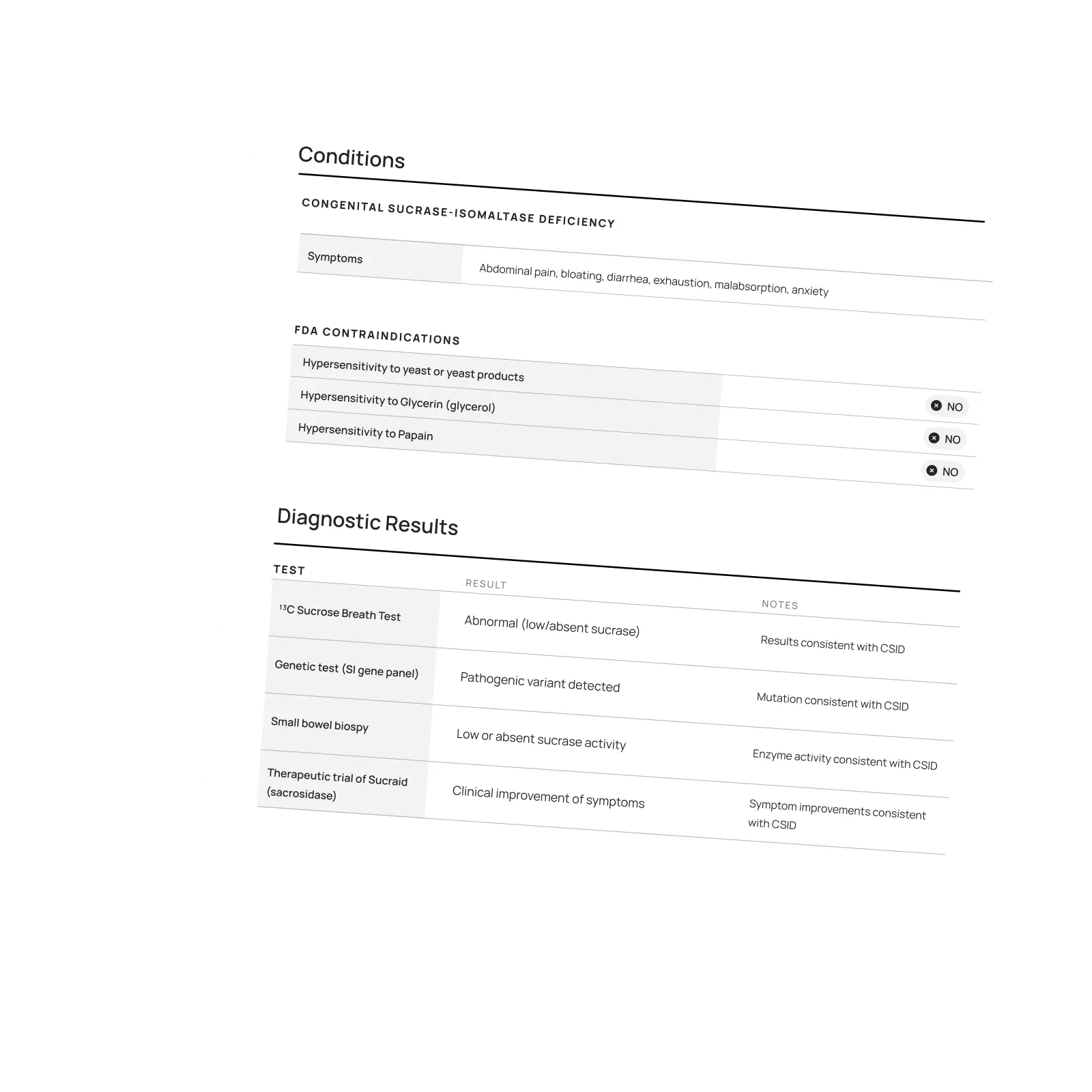

Essential Components of an Effective LOMN

To ensure your LOMN is impactful, include these key sections:

- Introduction: Briefly state your credentials and role in the patient’s care to establish expertise. Highlight your direct involvement in diagnosis, treatment planning, and ongoing management.

- Diagnosis: Clearly state the diagnosis, how it affects daily functioning, and why specific codes matter. If applicable, note progression or complications that make timely treatment essential. Specify how the patient meets standard clinical criteria.

- Medical History: Summarize past treatments, including durations, outcomes, and why they were ineffective. If any treatments were discontinued, specify the reasons (e.g., side effects, lack of efficacy). Address needed exceptions to step therapy.

- Necessity of Treatment: Explain why this is the most appropriate (or only) option, considering medical necessity, patient-specific factors, and cost-saving benefits for patients and insurers/employers. (See example: CSRO Letter on White Bagging)

- Non-Standard Criteria: Call out insurer policies that use non-standard criteria that contradict clinical guidelines. For example, denying the only FDA-approved treatment for patients with rheumatoid arthritis or cancer.

- Supporting Evidence: Include relevant medical records, lab results, and imaging. Reference clinical guidelines and peer-reviewed studies to strengthen your case and ensure the latest research is on record for future appeals and legal action.

- Urgency: Highlight risks of delaying treatment, particularly if deterioration or irreversible harm is likely. If relevant, include studies showing long-term consequences of delayed care.

Did you know? You can request a 72-hour expedited appeal if a delay risks your patient’s health. Your LOMN must state the urgency and document at least one risk factor, such as hospitalization, severe pain, ongoing care, disability risk, or time-sensitive treatment. Some states, like Illinois, broadly define urgency, including impairments to maximal function.

Final Thoughts

An effective LOMN not only strengthens your patient’s appeal but reinforces your role as the expert on their care. It’s a powerful tool that forces insurers to recognize the real-world impact of their decisions. By laying out the necessity of treatment in clear, compelling terms, you make it harder for them to justify a denial. And by challenging every unjust denial, you help create accountability—making insurers less likely to deny necessary care in the future.

At Claimable, we believe everyone should get the care and coverage they deserve. That’s why we’ve built tools to help providers challenge denials faster and more effectively. If you’re ready to take control of the appeals process, join us.

Ready to empower your practice and transform how you handle appeals?

Sign-up now for more expert resources and join our community of forward-thinking providers.

Watch the Interview with PANDAS Network's Executive Director, Diana Pohlman, and Claimable's CEO, Warris Bokhari sharing how to fight IVIG denials with Claimable.

Webinar Hosted by PANDAS Network:

Helping Families Appeal IVIG Insurance Denials: A Conversation with PANDAS Network

Health insurance denials for IVIG therapy can be a major hurdle for families affected by PANDAS/PANS. That’s why we were honored to join a recent webinar hosted by Diana Pohlman, Executive Director of PANDAS Network, where our CEO and Co-Founder, Warris Bokhari, MD shared how Claimable is helping families navigate the appeals process.

I didn’t appreciate…how unique what you’re doing is in our modern era right now. Utilizing AI not for the distance future, but for the here and now.

—Diana Pohlman, Executive Director, PANDAS Network

During the conversation focuses on the challenges families face when seeking IVIG coverage and how Claimable’s AI-powered tools are making a difference in successfully overturning denials.

Check out the Webinar at PANDAS Network.

Featured stories

In the news

Download a winning sample appeal

Want to see what it takes to successfully overturn a health insurance denial? Download our sample appeal to learn how we build strong, evidence-based cases that get results.

///////////////////////////////////////////////////////////////////////

//////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////

/////////////////////////////////////////////

Each month, I endure about eight major episodes, each one leaving me exhausted, unable to concentrate, and too unwell to take part in daily life.

The frequency and unpredictability of these symptoms have isolated me socially and limited my capacity to take part in activities most people take for granted.

///////////////////////////////////////////////////////////////////////

//////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////

/////////////////////////////////////////////

Be the first to know

Get the latest updates on new tools, inspiring patient stories, expert appeal tips, and more—delivered to your inbox.

You're on the list!

One of our core principles is to help patients protect their rights and level the playing field with their insurance company. This includes rights to multiple appeals, fair reviews, decision rationale, exceptions when needed, and adequate network access, among others. For more, read our post on patients rights.

Claimable’s AI-powered platform analyzes millions of data points from clinical research, appeal precedents, policy details, and your personal medical story to generate a customized appeals in minutes. This personalized approach sets Claimable apart, combining proprietary and public data, advanced analysis and your unique circumstances to deliver fast, affordable, and successful results.

We currently support appeals for over 85 life-changing treatments. Denial reasons may vary from medical necessity to out of network, and we even cover special situation like appealing plans that won’t count your copay assistance towards your deductible (hint: those policies were banned at the federal level in 2023). That said, we are rapidly growing our list of supported conditions, treatments and reasons. You can quickly check eligibility and ask to be notified when your interest becomes available. It helps us know where to focus next 🙂

We think about appeal times in a few ways. First, many professional advocates and experienced patients spend 15, 30 or even 100 hours building an appeal–but with Claimable, this takes minutes. We automate the process of analyzing, researching, strategizing and wordsmithing appeals. Next, there is the process of figuring out where you will send it (hint: expand your reach beyond appeal departments), then printing, mailing and/or faxing your submission. We handle that, too. Finally, there is the time it takes to get a decision. We request urgent reviews when appropriate, and typically receive standard appeal decisions within a couple weeks.

Review periods are mandated by applicable laws, from 72 hours for urgent, 7 days for experimental, 30 days for upcoming and 60 days for received services. Our goal is to get a response as fast as possible, since most of our clients are experiencing long care delays or extreme pain and suffering.

Claims are denied for a variety of reasons, many of which blur definitions. We focus on helping people challenge denials by proving care is needed and meets clinical standards, in addition to addressing specific issues like experimental treatments, network adequacy, formulary or site of care preference exceptions. We don't support denials for administrative errors or missing information, as we think those are best handled by simply resubmitting the claim in partnership with your provider. That said, many of our most rewarding successes have been cases previously though 'unwinnable', with providers and patients who fought tirelessly for months without appropriate response or resolution.

A denial letter is a formal notice from your insurance company explaining why a claim was denied and how you can appeal the decision. Sometimes the notice is included within an Explanation of Benefits. It is a legal requirements; if you didn’t receive one, contact your insurance company.

A letter of medical necessity is a statement from your doctor justifying why a specific treatment is critical to your care and/or urgently needed. You can attach it to your patient appeal to strengthen your case, especially if you are requesting an urgent appeal or need to skip standard ‘step therapy’ requirements. That said, we don’t require them and are often successful without them.

A claim file contains all the documents and communications your health plan used to decide whether to approve or deny your claim. Most health plans are legally required to share this information upon request. According to a ProPublica investigation, reviewing your claim file can help expose mistakes or misconduct by your health plan, which can make your appeal stronger.

Your insurer is required by law to give you written information about how to appeal, including the name of the company that reviewed your claim and where to send your appeal. Your health insurer may work with other companies, such as Pharmacy Benefit Managers (PBMs), Third-Party Administrators (TPAs), or Specialty Pharmacies, to manage your claims. These companies might be responsible for denying your claim and handling the appeal process on behalf of your insurer.

If you don't win your first appeal– don't give up! Many people are successful on their 2nd, 3rd or even 4th try, and future appeals are reviewed by independent entities. That said, we wrote a whole guide to understanding your options, including escalating your appeal and seeking other assistance for covering costs, forgiving debt or even seeking legal or regulatory support.

While both denial rates and appeal success rates vary widely by the type of health plan, state, and insurance company, studies have shown more than 50% of people win their appeal–and we apply strategies to boost your chances of success. Claimable has an 80% appeal success rate. The biggest denial challenge is that most people never appeal–allowing unjust denials to control their healthcare options because they are unaware of their rights or lack the support needed to fight back. No one needs to fight alone–Claimable is here to help. We know first hand that many denials are based on errors, inconsistencies or auto-decisions, and have proven strategies for fighting back against this injustice.

Let’s get you covered.